Navigating Ultimate Beneficial Ownership Regulations in Sweden

Transparency continues to be key focus for governments and the public globally. Foreign companies with activities in Sweden may need to register beneficial ownership information in Sweden. Also, international standards regarding anti-money laundering and countering financing of terror have resulted that banks and other service providers are under increased obligations to document the beneficial ownership of their clients.

Which foreign companies must register beneficial ownership information?

Foreign companies and associations with business activities in Sweden may need to register beneficial ownership information with the Swedish Companies Registration Office (Sw. Bolagsverket).

They are subject to the same rules as the equivalent Swedish company type. Foreign companies and associations within the European Economic Area (EEA) do not need to register information in Sweden if they will be registering this information in the beneficial ownership register of another EEA country.

Identify whether you have beneficial owners

The first step for the foreign company is to identify whether they have beneficial owners and who this or these individuals are.

If they have one or more beneficial owners, the foreign company must then identify the type and the extent of their control (as a percentage) for each individual.

The foreign company may reach the conclusion that there is no individual who ultimately owns or controls the entity and therefore there is no beneficial owner to register.

The foreign company may reach the conclusion that due to the information available, it is not possible to identify whether there are beneficial owners or not, or that there is a beneficial owner but cannot identify who this individual is.

What is beneficial ownership?

Beneficial owners are individuals who ultimately own or control a foreign company. An individual can control a foreign company in various ways, such as by

- holding more than 25 percent of the votes through shares, voting rights or ownership interest

- holding the right to appoint or remove a majority of the board of directors, or equivalent of senior management.

There may even be agreements or provisions in the articles of association, company agreement or similar documents which could indicate that an individual is a beneficial owner.

If the foreign company is based in a country within the EEA, the identification of beneficial owners must be done using the Swedish definition and rules.

Close family members

If an individual owns or controls a foreign company together with close family members, their percentage of control is added together. The following count as close family members: spouses, partners, registered partners, parents, children and children’s spouses, partners or registered partners.

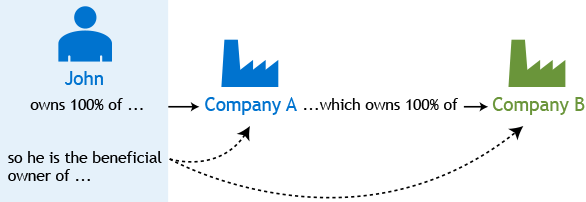

Other companies

In a group of companies, beneficial owners are the individuals who own or control the company which ultimately controls all the other companies in the group.

Example

A foreign company has activities in Sweden. The company is based in Germany and has registered beneficial ownership information there. The company does not need to register the information in Sweden as well.

A foreign company has activities in Sweden. The company is based in Canada and is comparable to a Swedish limited company. The company must therefore follow the same rules as for Swedish limited companies when registering beneficial ownership information.

Submit beneficial ownership information electronically

Once the foreign company has identified whether there are any beneficial owners and who this or these individuals are, they must register the information with Bolagsverket. They must still register even if they cannot identify who the beneficial owners are.

Registration of beneficial ownership information is done via an e-service on bolagsverket.se. An authorised representative for the foreign company logs into the e-service and fills in the relevant information. Please note that the e-service is in Swedish only.

Changes to beneficial ownership information must also be registered with us in the same way.

Information to be included:

- company registration number

- company name

- full name, Swedish personal identification number or date of birth, nationality and country of residence for each beneficial owner

- type of control, that is, in what way the beneficial owner controls the company or association

- extent of control, as a percentage

- information about whether the individual (or individuals) own or control the foreign company or association together with close family members or through other companies.

Summary

Registering the beneficial ownership of a company operating in Sweden is a somewhat exhausting administrative exercise as it often requires gathering registration and identification documents for many legal entities and individuals.

However, in addition to the registering the beneficial ownership with Bolagsverket, increasing legal requirements on banks and other financial institutions has led to that the ultimate beneficial owner documentation needs to be presented to various third parties in Sweden.

For this purpose, complying with the UBO regulations is not only a legal requirement, but also a responsible business practice that promotes integrity, transparency and integrity and helps foreign companies getting started with their business in Sweden.